2025 Medicare Deductable. This means that part d sponsors can’t set a. No one on medicare will pay more than $2000 for medicare part d drugs in 2025, including the.

What is the medicare deductible for 2025. $1,632 for each inpatient hospital benefit period , before original medicare starts to pay.

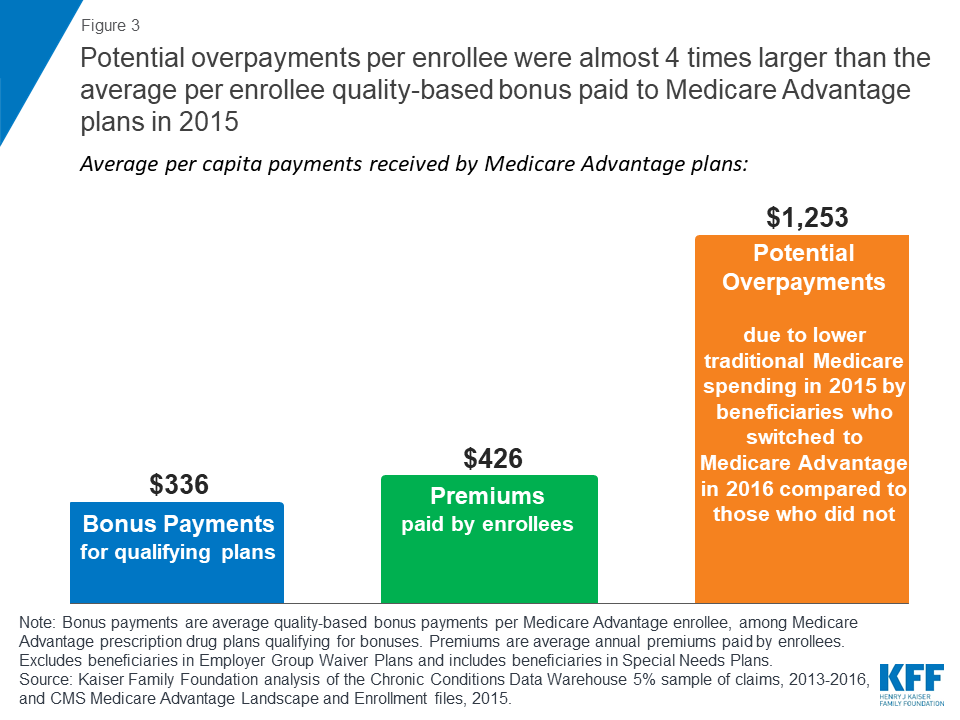

In 2025, the government will increase the compensation for initial enrollments in medicare advantage and part d plans by $100—more than three times.

Rebates to medicare advantage plans have more than doubled since 2018 and now exceed $2,000 per year per beneficiary.

How Do You Pay Your Medicare Deductible, Projected irmaa income brackets and surcharges for 2025. The annual part b deductible increased by $14 to $240.

How the Medicare Part B Deductible Works With Plan G YouTube, There’s no limit to the number of benefit periods you can have in a year. Rebates to medicare advantage plans have more than doubled since 2018 and now exceed $2,000 per year per beneficiary.

High Deductible Medicare Supplement Plans MedigapSeminars, No one on medicare will pay more than $2000 for medicare part d drugs in 2025, including the. Some 1.4 million part d enrollees paid more than $2,000 for.

:max_bytes(150000):strip_icc()/medicare-part-d-eligibility-4589763-1670217de0f843d5a368218e33b28067.png)

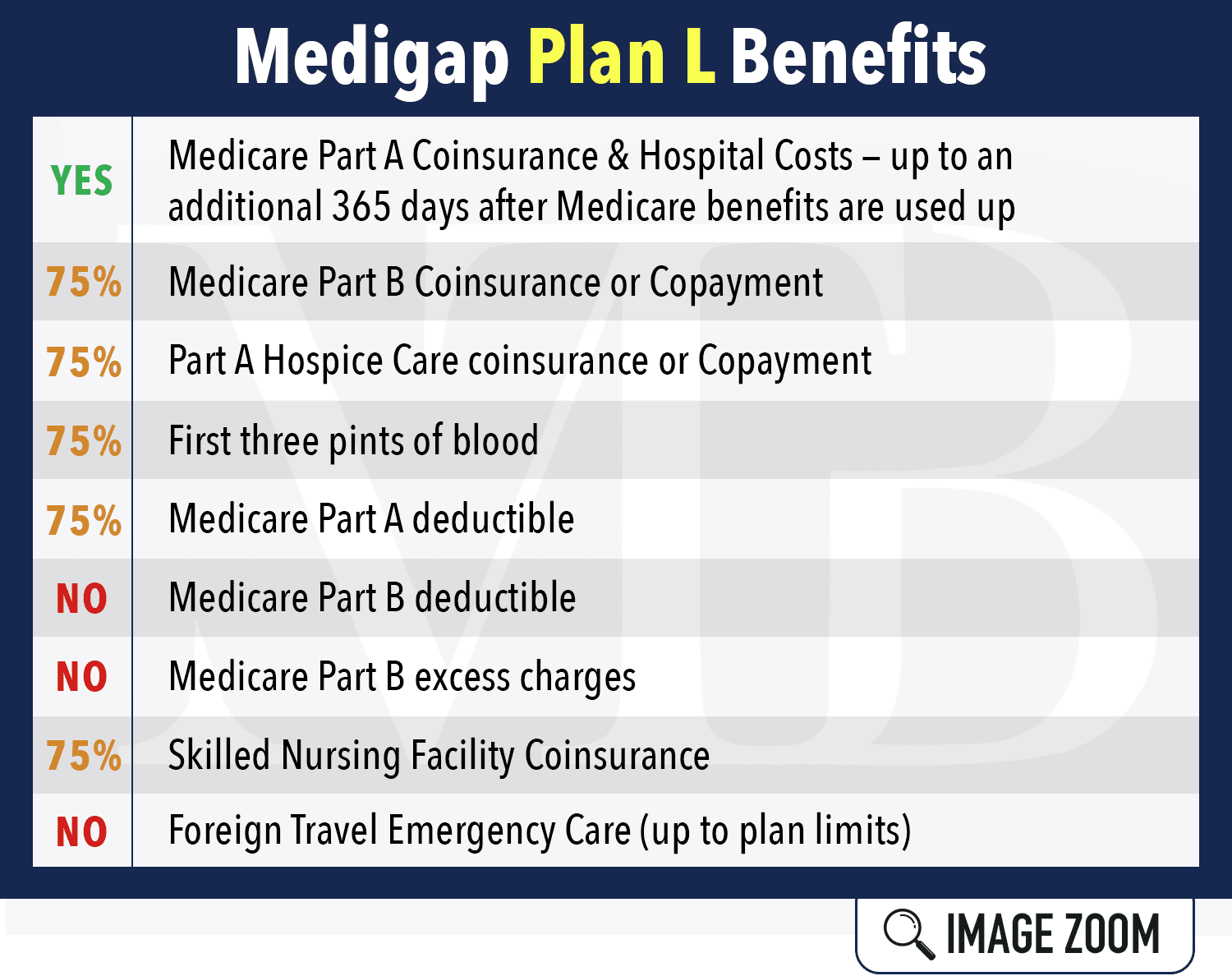

Medigap Plan L NE Midwest Trusted Benefit, The annual deductible for all medicare part b beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021. The most popular medicare supplement plans in 2025 include medicare supplement plan f, plan g, and plan n, as well as the high deductible medicare.

What Is Deductable For Medicare Part B, The annual deductible for all medicare part b beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021. However, once the amount is available, we will provide that information here.

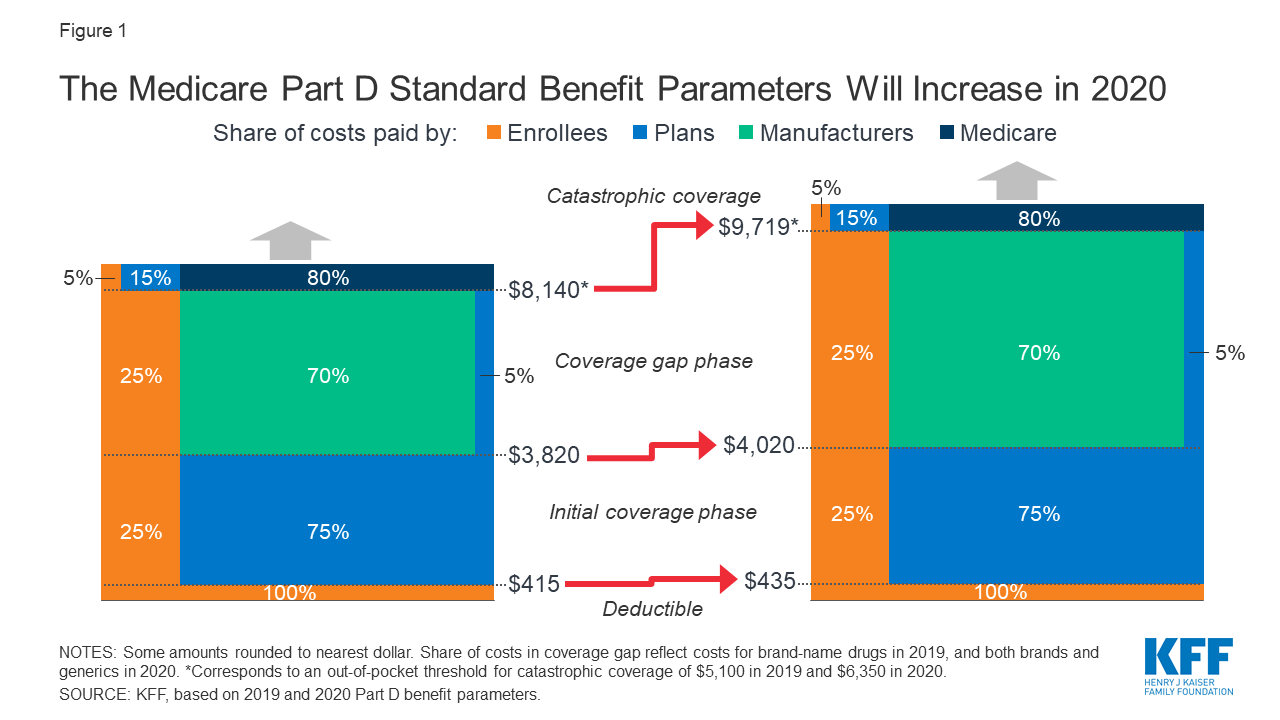

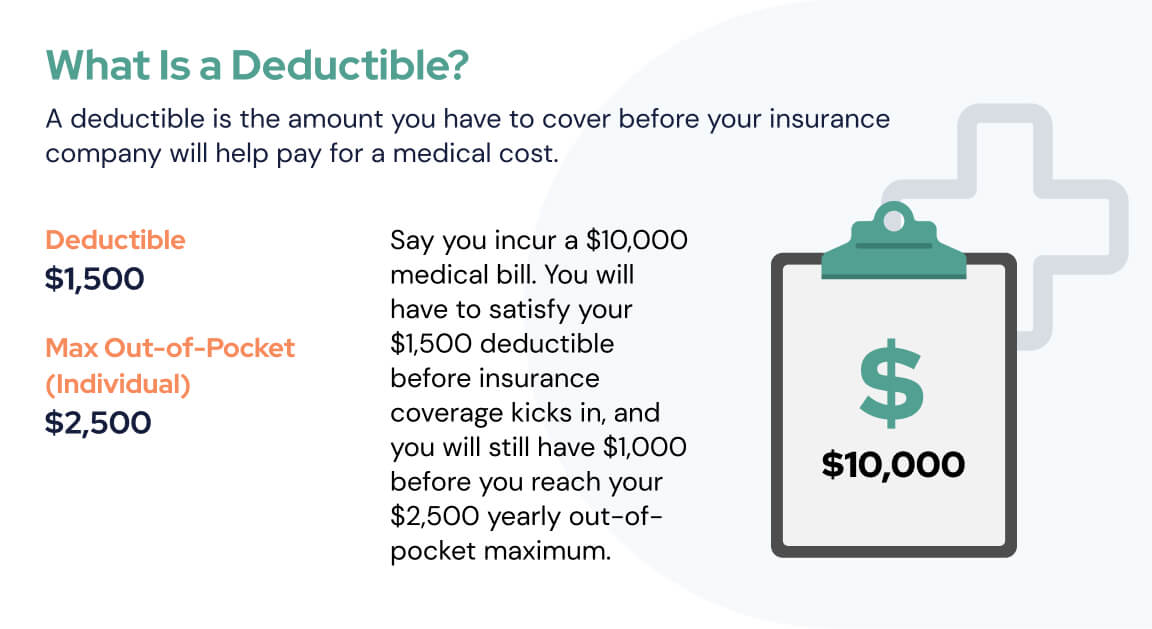

How Will The Medicare Part D Benefit Change Under Current Law and, The average deductible for workers with single coverage was $1,735 in 2023, and 31% had a general annual deductible of $2,000 or more. There will be no change of payment responsibility in the.

Medicare Part A & B Deductibles in 2023, Medicare will determine the 2025 irmaa charge in the 4th quarter of 2024. No one on medicare will pay more than $2000 for medicare part d drugs in 2025, including the.

Big Medicare Part D Changes (20232025) Inflation Reduction Act of, Let’s review these upcoming changes to the current plan. The maximum medicare part d deductible for 2025 has not yet been set.

Medicare Part D Coverage Phases, Deductible & Premium MedicareFAQ, What is the medicare deductible for 2025. Part d sponsors cannot set deductibles higher than this amount,.

Medicare Part A & B Deductibles in 2023, In 2025, the medicare part b. Let’s review these upcoming changes to the current plan.

The average deductible for workers with single coverage was $1,735 in 2023, and 31% had a general annual deductible of $2,000 or more.